- Insolvency Insider UK

- Posts

- Grayton Group Holdings enters administration following post-acquisition cash flow pressures

Grayton Group Holdings enters administration following post-acquisition cash flow pressures

Grayton Group Holdings Limited, formerly RDCP Investments 31 Limited, entered administration on 20 November 2025, with James Neill and John Donaldson of KPMG appointed as joint administrators by secured lender BPC UK Lending DAC under its qualifying floating charge.

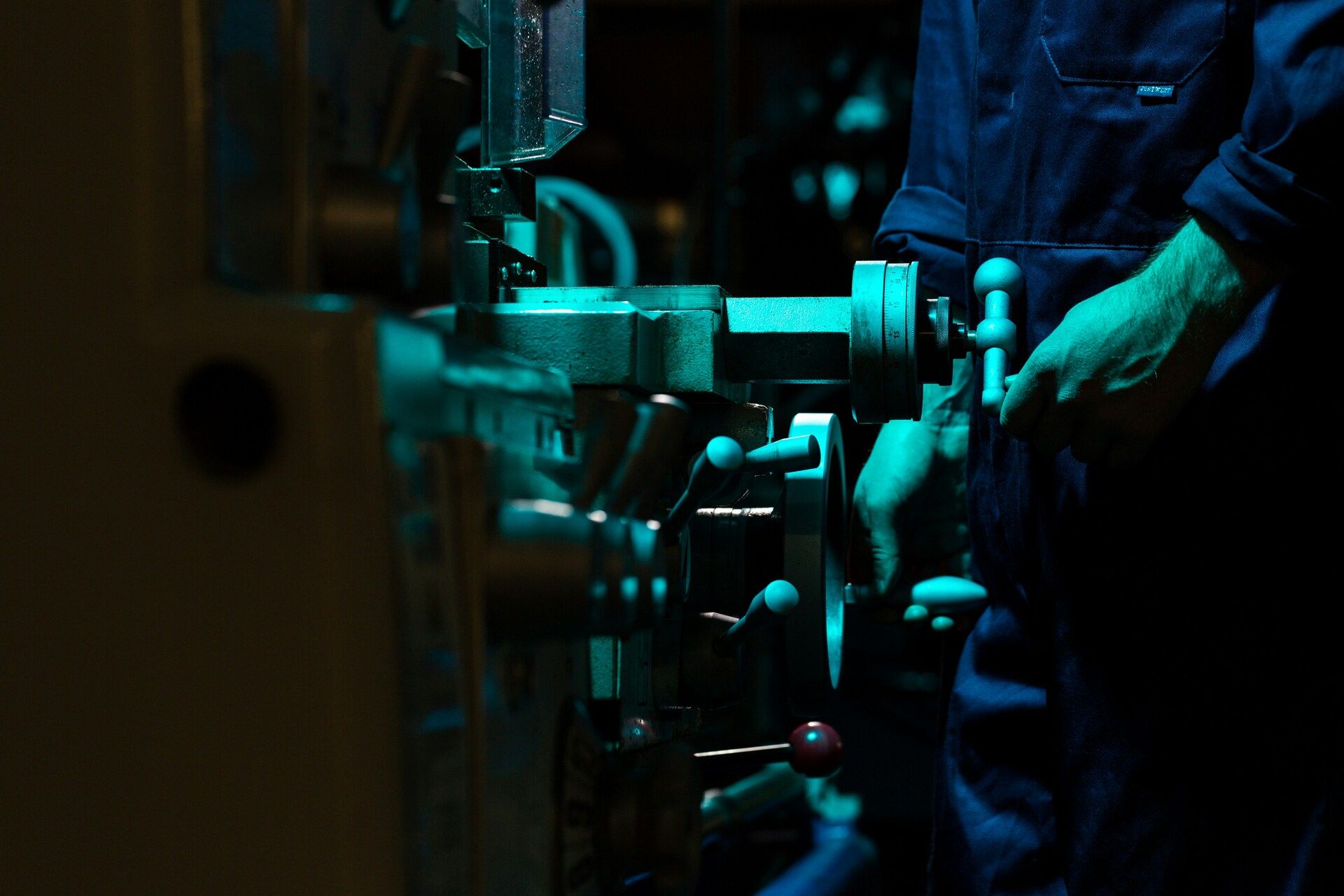

The company was incorporated on 24 October 2024 as a non-trading holding vehicle to facilitate the acquisition of the Grayton group. It sat at the top of a structure that ultimately owned Grayton Limited and Richard James Engineering Limited, two long-established mechanical engineering services businesses specialising in the repair, maintenance, and replacement of industrial machinery and equipment. The trading operations are based in Barton-upon-Humber and together employed more than 100 people at the time of the administrators’ appointment.

As part of the 2024 acquisition, BPC provided a £6.25 million funding facility to the holding company, cross-guaranteed across the group and secured by fixed and floating charges, including a fixed charge over the holding company’s shares. Although the group had historically been profitable, performance deteriorated following the transaction, with rising cash flow pressures leaving the holding company unable to meet its financing obligations as they fell due. By November 2025, management was projecting a material cash shortfall by the end of the year, prompting BPC to engage advisers and ultimately enforce its security through an administration appointment.

Following their appointment, the joint administrators commenced a marketing process for the company’s shareholding, circulating a teaser to 49 potential buyers and running a compressed sale timetable given the liquidity pressures at the trading level. Three offers were received, all conditional on continued lender support. After consultation with BPC, Grayton Engineering Group Limited, a connected party owned and managed by two of the company’s directors, was selected as the preferred bidder. An independent evaluator provided a qualifying report concluding that the proposed connected-party sale was reasonable, and an external valuation confirmed that the offer exceeded the estimated realisable value of the shares.

The sale completed on 19 December 2025. Consideration totalled £6.82 million, structured largely through the assumption of approximately £6.64 million of secured debt owed to BPC, together with a cash payment of £178,201 into the administration estate. The transaction preserved both trading subsidiaries as going concerns and safeguarded more than 100 jobs, while delivering a distribution to the secured lender under its fixed charge. No distribution is expected for unsecured creditors.