- Insolvency Insider UK

- Posts

- Peak Analysis and Automation enters administration as BABR clinches rapid sale of core UK division

Peak Analysis and Automation enters administration as BABR clinches rapid sale of core UK division

Peak Analysis and Automation Limited (PAA) has entered administration following mounting financial strain, triggering a swift cross-border sale of one of its two UK divisions along with its US robotics subsidiary.

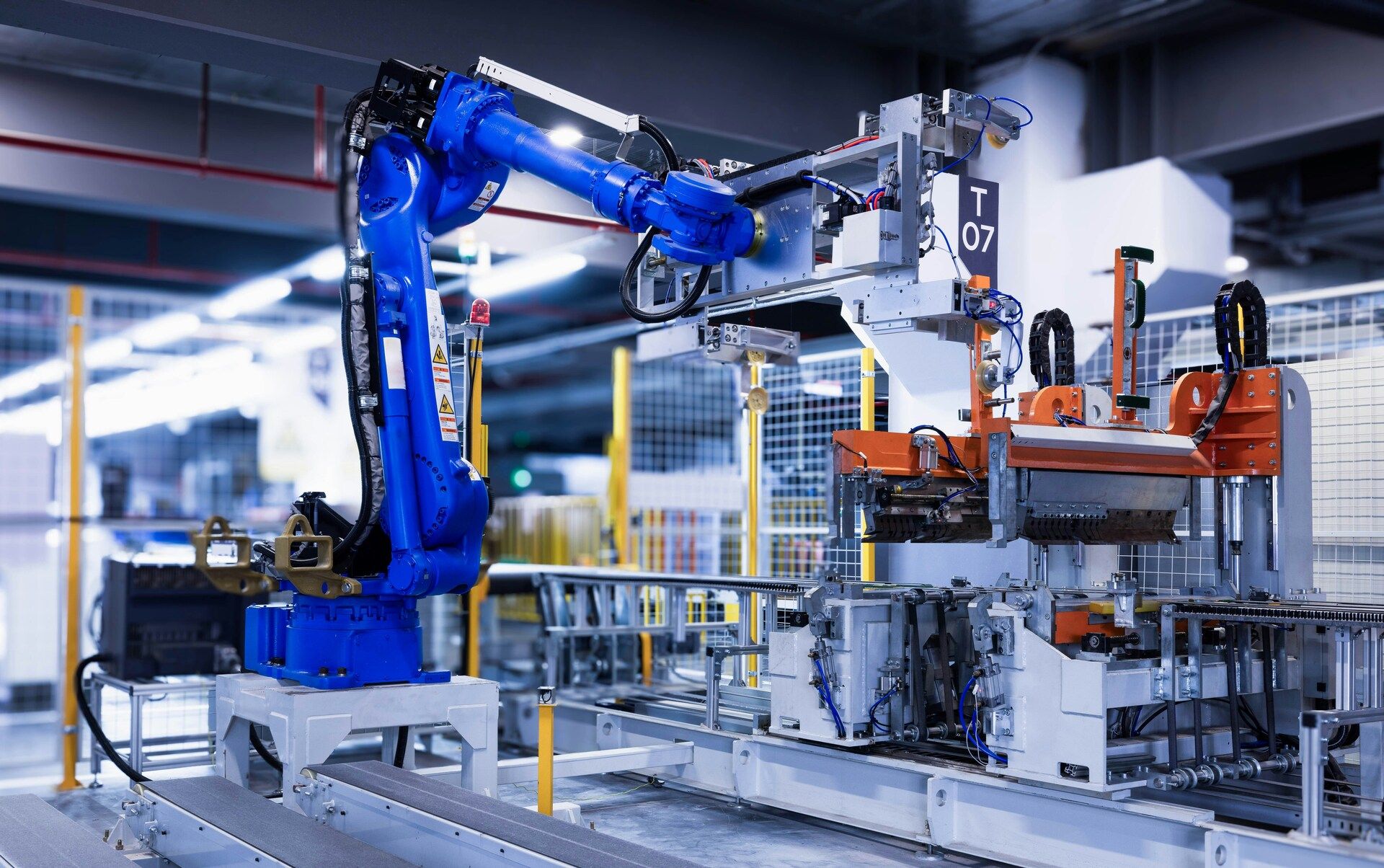

Nick Cusack and Paul Bailey of BABR were appointed joint administrators on 24 October and moved quickly to stabilise operations at the long-established laboratory automation provider. PAA is known for modular platforms such as SCEL, Smart Cart robotic systems, and proprietary scheduling and orchestration software, with its US arm Peak Robotics Inc. (PRI) manufacturing collaborative robots including the KX2 and S LAB plate stacker.

According to BABR’s statement, the firm had been advising PAA prior to the appointment and was positioned to launch an immediate marketing process once the administration commenced. The administrators completed a time-sensitive sale to Grenova Inc., a sustainability-focused laboratory solutions group, which acquired one of PAA’s UK divisions together with PRI . The remaining UK division is now being marketed separately.

The transaction preserved more than 25 jobs and maintained continuity for PAA and PRI customers during a period marked by intensified operational and liquidity pressures. Cusack described the deal as a critical cross-border outcome that kept an established UK automation business intact within a larger global platform. Bailey highlighted the importance of running a transparent process under challenging circumstances, noting the support of Freeths LLP as legal advisers and Wyles Hardy on valuation.

Grenova plans to integrate the acquired PAA division and PRI into its international automation portfolio as it expands its robotics and sustainability-driven solutions in the laboratory sector.

BABR continues to oversee the administration while advancing the sale process for the remaining UK division.